Quarterly report | Q1 | Baltic States

Property

Snapshot

Q1 | 2022

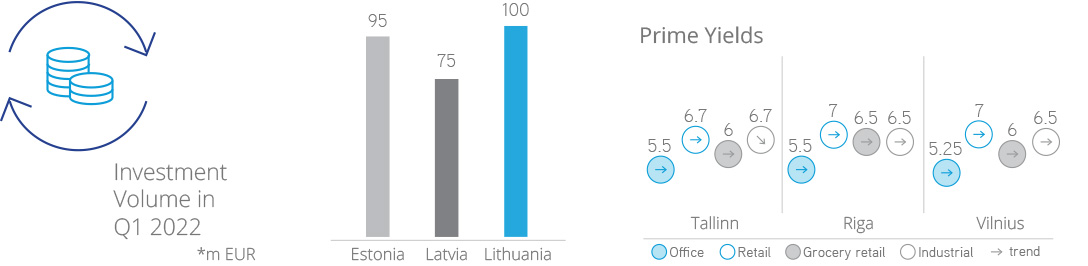

Investment market

After a record high investment volume achieved in 2021 (EUR 624 million in total), the capital market in Estonia started the year with considerable activity and a total investment volume amounting to ca EUR 95 million in Q1 2022. The year started with the sale of the GoSpa hotel building (92 rooms, 6,600 sqm) in Kuressaare by East Capital to a company related to the operator of the hotel. Retail and Stock Office properties continue to attract constant interest from investors. In Q1 2022, Fausto Group sold its retail portfolio (SC and grocery stores; 4 locations across Estonia) to Capital Mill, while Restate, a developer, sold Tähesaju Twins Stock Offices (2 buildings, of which one is completed, and another is under construction) in the Tähesaju area of Tallinn. Additionally, LHV pension funds purchased the office building at Sõpruse pst 157 (2,500 sqm). Due to available financial capital, surging inflation and lack of investment-grade products, end-2021 saw continual yield compression towards 5.5% in the office segment and 6.7% in the industrial segment.

Key Investment Figures in the Baltic States, Q1 2022

Prime Yields

Estonia

Latvia

Lithuania

Office

5.5%

5.5%

5.25%

Retail

6.7%

7.0%

7.0%

Industrial

6.7%

6.5%

6.5%

Source: Colliers

In Q1 2022, total investment volume in Latvia exceeded EUR 75 million, with several notable investment transactions and half of the activity again observed in the retail segment. Green Formula Capital acquired the K-3 Mall of Imanta, while Lords LB sold Rimi HM to Hili Properties for EUR 20 million and DINO ZOO Pasaule big-box on Krasta St. Two nonprofessional office buildings from the former PNB bank portfolio were sold for EUR 8.3 million, while Baltic RE Group sold the Šķūnu 19 office building in Old Town for EUR 5.7 million. The rental residential segment continues to gain momentum – LHV acquired 5 rental apartment buildings (3 of them newly built in 2021) with more than 100 apartments in total for EUR 9 million in the Avoti district. Significant activity was also observed in the development segment with more than EUR 35 million spent on development properties. After a less active previous 2 years, transactions are again seen with apartment buildings that require renovation in Riga’s Historic Centre. Investor interest in grocery-led retail objects and sale-leaseback transactions remains high. Yields currently remain unchanged.

According to preliminary data, in Q1 2022, total investment in the Lithuanian market amounted to EUR 100 million. The first quarter of the year was rather volatile, with the beginning of the year enjoying a good start in terms of investor interest and purchases, while since the end of February, with the outbreak of the war in Ukraine, market players became more cautious about properties they buy. After seeing that the conflict was likely to be limited to the territory of Ukraine the situation stabilised, and the end of the quarter remained positive from an investment point of view. The industrial segment accounted for the largest share of investment volume (more than 45%). Vilniaus Baldai, the largest furniture manufacturer in Vilnius, sold its entire premises on Savanoriu Ave. to its major shareholder for more than EUR 10 million. In Vilnius, the retail sector also witnessed one of the largest transactions: the sale of the Mandarinas SC by investment fund Lords LB Baltic Fund III to PREF III. Among the largest transactions in the office segment was the sale of the Jin&Jan BC in Vilnius. Compared to the previous quarter, yields on core investments remained unchanged.

Office market

Development in the Tallinn office market remains continually active with total GLA of almost 155,000 sqm (14.1% of total stock; 17 projects) under construction in March. Rising construction and utility costs are heavily impacting asking rents for new office premises as well as the pace and potential of further development activity in 2022 (some development will be delayed due to high market uncertainty). In Q1 2022, the asking rental level for new premises / premises under construction increased by an additional 1-2 EUR/sqm/month compared to 2021. Thus, asking rent rates for premises under construction in CBD have already surged from 16-18 EUR/sqm/month on average in 2021 to 18-20 EUR/sqm/month in March 2022 and continue to trend upwards. Vacancy continues to fluctuate around 7%, seeing some continuing decline in Class A buildings.

Key Office Figures in the Baltic States, Q1 2022

Class

Tallinn

Riga

Vilnius

A Class Rents

14.5-19

14-17

15-18

B1 Class Rents

9.8-16

9-14

10-15

A Vacancy*, %

6-7%

17-18%

5-6%

B1 Vacancy*, %

7-8%

13-14%

11-12%

Source: Colliers . EUR/sqm/month; *-speculative office market vacancy rate

In Q1 2022, more than 160,000 sqm of leasable office space remained under construction in Riga and taking into account the large project pipeline, the geopolitical situation and increasing construction costs, we might see fewer than expected new projects started in the foreseeable future. Increasing costs are also putting further pressure on rent rates both for pre-lease agreements and for agreements in existing projects that require fit-out. Demand for office premises remains similar to last year, seeing increased interest in signing pre-lease agreements especially for projects that are scheduled to be finished soon. Notable pre-lease transactions include Decta signing a pre-lease for 2,300 sqm in Verde, Class A office building, developed by Capitalica. The market is also seeing enquiries from companies with a view to relocating their offices from countries affected by war or sanctions; however, no notable transactions have yet happened.

Office Trends

Source Colliers

In Q1 2022, the Vilnius office market saw completion of 3 business centres – Business Stadium North East, Naujasis Skansenas Ž and Freedom 36, adding 36,070 sqm of leasable area to the office market in Q1. Development pipeline remains high with around 183,400 sqm in active construction phase. Of this, a further 114,200 sqm is expected to be completed this year and 69,200 sqm in 2023. First quarter was relatively quiet in launching new construction projects, however, there is a high activity of projects in design stage. The rental market remains active with 20,400 sqm of space leased in Q1. Strong activity is expected to continue throughout the year with few larger transactions expected for closing in Q2. Demand is predominantly generated by expansion of existing businesses and further positive migration of high-quality specialists to the country.

Retail market

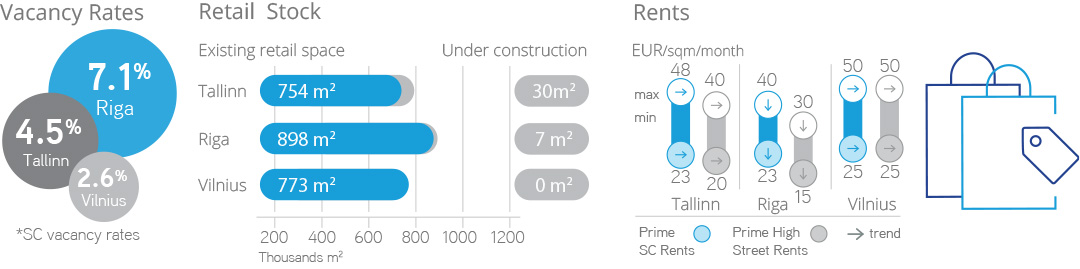

The Tallinn retail market remains inactive, with no new projects added to the market but no new remarkable additions expected during 2022. Some development activity is continually under way in Tallinn’s neighbouring municipalities (e.g., IKEA, Tabasalu Centre, Prisma supermarkets), but the same as in other RE segments, due to rising construction costs, some projects will be delayed and/or postponed. The most significant market entry in Q1 2022 was the opening of the first 8 LIDL stores in Estonia, incl. 5 stores opened in Tallinn. As a result, so far, Lidl’s market share of total grocery space in Tallinn comprises 4%. Shopping centres continue diversification of their tenant mix. Viru Keskus SC announced the addition of a wellness, beauty and aesthetic medicine centre to its tenant mix in 2022. The future wellness centre will include such well-known establishments offering services such as Confido Medical Centre (400 sqm), MakeYourID, Niine Nahakliinik, NailSpa.

No notable projects were announced or added to the market in Riga in Q1 2022. However, professional retail objects continued to change owners and improve their strategies. K3 Imanta Mall (also known as Imantas Tirgus) was acquired by Green Formula Capital, while the recently-acquired SC Alfa was renamed as SC Akropole Alfa (the existing SC Akropole is now SC Akropole Rīga). Since 1 March, shopping centres were open to everyone and starting from 1 April, shopping centres can operate as usual, meaning that Q2 2022 will show / confirm the real impact from

Retail Trends

Source Colliers

the change in people’s shopping patterns as a tendency to make fewer shopping trips but with a higher average purchase has been observed since the start of the pandemic. There is a small increase in shopping centre vacancy in Q1 though mostly due to some planned tenant changes. Most demand still comes from discounters with their remaining interest in expanding outside Riga, as well as increased interest in being located close to or within office complexes and other mixed-use projects that are currently being developed.

In Q1 2022, retail stock in Vilnius stood unchanged and no new projects were announced. However, as expected, existing retail facilities are now focusing on refurbishments and major improvements. IKI Vilnius (ex Minskas) reopened after reconstruction and Europa SC opened a new space – the "Dialogai" food court. Additionally, SC Pupa and SC Panorama received BREEAM certificates after completion of improvement works. SC Ozas continues to focus on leisure & entertainment and opened a new 3,500 sqm interactive entertainment centre: "Action! by Apollo". Another dark store was enrolled in the market by Wolt, offering express grocery deliveries. Vacancy in prime shopping centres in Vilnius slightly decreased, while rent rates remained stable. However, increased utility costs are becoming a major challenge for restaurants and coffee shops. Since 5 February, the COVID vaccination passport was suspended, and face masks will no longer be mandatory in most indoor environments from April. On the other hand, the consumer confidence index was negatively affected by the war in Ukraine and the sanctions imposed on Russia and Belarus.

Key Retail Figures in the Baltic States, Q1 2022

Tallinn

Riga

Vilnius

Prime SC Rents*

23-45

23-40

25-50

Prime High Street Rents*

25-40

15-30

25-50

Vacancy in SC

4.5%

7.1%

2.6%

Source: Colliers . *EUR/sqm/month; SC – shopping centre

Industrial market

The industrial segment remains rather active in Tallinn and its suburbs in terms of new developments with a total area of approx. 142,700 sqm (40 projects) under construction in March and several large-scale projects in the pipeline. Still, due to the fact that rising construction and utility costs are heavily impacting asking rents for new premises (starting from 5.5 EUR/sqm/month), some development will be delayed and/or put on hold. As a result, existing buildings are starting to gain some advantages due to buoyant demand and plans by various companies to expand, resulting in upward movement of asking rent rates. Development of stock-office premises continues to trend upwards with at least 60,050 sqm (17 projects) remaining under construction.

Key Industrial Figures in the Baltic States, Q1 2022

Tallinn

Riga

Vilnius

Prime Rents*

3.9-5.5

4.0-4.7

4.0-4.9

Vacancy

3.1%

1.6%

0.1%

Source: Colliers . *EUR/sqm/month

In Q1 2022, the Riga industrial market has been quiet, no new projects were started and no notable projects finished. For now, construction of development projects (GLA >180,000 sqm) continues, while no new developments were planned to start around this time. Similar to the beginning of the Covid-19 pandemic, we at Colliers see some uncertainty in the market and strategic decision postponements. Even so, notable developers increased their land bank – Piche acquired two more land plots in Marupe, and Sirin acquired a land plot in the same area. As expected at the beginning of the year, vacancy is decreasing and currently remains below the 2% level. Increasing construction costs together with a lack of supply continue to put upward pressure on rent rates.

In Q1 2022, the Vilnius warehouse market observed completion of the Liepkalnio Industrial Park (stage IV, GBA 20,000 sqm) developed by SIRIN and the start of construction work on J55 LC (2nd part of stage II) encompassing roughly 13,500 sqm of speculative warehouse space. Some 61,700 sqm remained under construction, of which over 82% consists of speculative projects. However, due to the increase in construction costs and disruption in supply chains of building materials caused by the war in Ukraine, some projects at the planning stage were put temporarily on hold. Occupier activity has been predominantly driven by lease renewals from retail trade companies and new pre-leases from shipping and last-mile delivery logistics, which was reflected in the total take-up of over 27,200 sqm. Rents remained stable, but under upward pressure due to rising construction costs.

Industrial Trends

Source Colliers

Trends for 2022

- As real estate has been always seen as a good hedge against inflation, interest in investing in cash-flow objects during a high-inflation period is expected to remain strong.

- Investor scrutiny towards cash flow quality will remain high, but with a wider list of criteria.

- Uncertainty is continually growing around the cost of debt and alternative financing sources.

- Investors are expected to continue the hunt for industrial assets as well as for hotel and retail properties.

- The geopolitical situation is forcing market players to pay increased attention to tenant risks.

- Developers are becoming hesitant about starting construction works due to high uncertainty regarding costs and availability of materials.

- Wood, metal, and other raw materials are becoming more expensive and there may be challenges in the future in equipping premises, as higher prices will make it more difficult, while importing raw materials will also be challenging.

- Some projects at the planning stage were already put temporarily on hold, a trend expected to continue.

- Projects under construction are meeting with increasing costs and uncertainty that put further pressure on rent rates.

- However, interest is increasing in acquiring land plots and a trend to use the current period to plan new developments.

- Lifted coronavirus restrictions will allow the office (due to workers returning to their office desks) & retail segments to finally operate at full speed / capacity.

- Rapidly rising prices will reduce purchasing power and limit growth in household spending in 2022.

- Increasing utility costs affect capitalization and thus the ability of several types of retailers to pay rent.

- Stock office projects have been well received in the Baltic market and more developers are expected to enter this segment in Lithuania and Latvia.

Contact

Maksim Golovko

Research & Forecasting | Estonia

Colliers International Advisors

Estonia Office

+372 6160 777

Toms Andersons

Research & Forecasting | Latvia

Colliers International Advisors

Latvia Office

+371 67783333

Dominykas Lusys

Research & Forecasting | Lithuania

Colliers International Advisors

Lithuania Office

+370 5 2491212

colliers.lithuania@colliers.com

© 2022 :: Colliers International